Top Secrets to Obtaining Reduced Property Policies for Your Business

Identifying the ideal landlord insurance for your business can feel intimidating, particularly when it involves to allocating funds for coverage. With many different various policies and providers on the market, it’s simple to ignore possibilities to reduce expenses. The good news is that you don’t have to accept for high premiums. By comprehending a couple of key tactics, you can get excellent deals on landlord insurance policies that support safeguard your investment without breaking the bank.

In this article, we will discuss five vital secrets to acquiring low-cost landlord insurance for your business. From contrasting quotes to utilizing potential discounts, these hints will enable you to formulate informed choices and ultimately reduce your insurance expenditures. Regardless if you manage residential units or industrial real estate, optimizing your discounts on insurance is both achievable and beneficial. Let's jump in and discover how you can optimize your coverage while maintaining your expenses in balance.

Understanding Rental Insurance

Landlord insurance is a dedicated type of coverage created to safeguard property owners from financial losses associated with renting out their units. In contrast to standard property owner coverage, landlord coverage not only covers the physical structure of the property but also provides liability protection against possible legal claims resulting from injuries or damages that take place on the site. This insurance is essential for property owners as it aids safeguard their investments and ensures they can cover unforeseen costs.

There are multiple types of rental property insurance policies on the market, each meeting diverse needs and risks. Basic policies typically feature coverage for property damage due to fire, storms, or deliberate damage, as well as liability coverage for accidents involving by tenants. Some policies furthermore provide optional enhancements like coverage for lost rental income, which can offer monetary assistance in case the property becomes not livable due to covered damages. Grasping the specific needs of your leased unit can guide you select the right type of insurance.

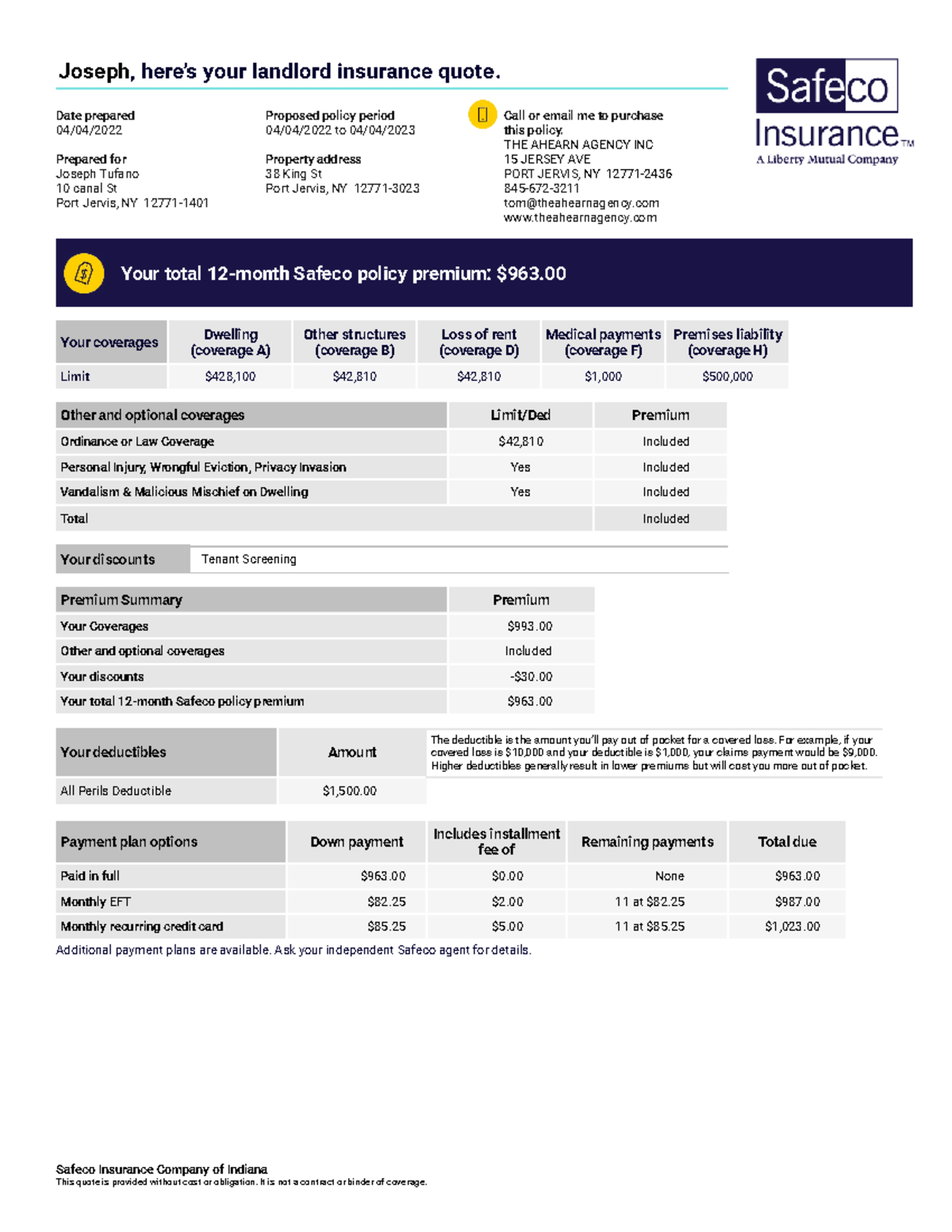

The price of landlord coverage can vary significantly based on various factors, including location, size of the property, and the level of insurance needed. Additionally, insurance companies may take into account the profile of the tenant and rental history. By comprehensively understanding the components of landlord insurance, property owners can identify potential savings, assess offers, and choose a plan that provides the best value for their business.

Analyzing Insurance Estimates

As you looking for landlord rental property insurance quotes, it's essential to evaluate various options to make certain you're receiving the best deal. Various insurance providers may present diverse rates for comparable coverage, so allocating effort to gather and analyze these quotes can save you cash. Look for online comparison tools that can facilitate this process by presenting several quotes in comparison.

As you are comparing quotes, pay careful consideration to the coverage limits and deductibles. Cheaper quotes may come with increased deductibles or restricted coverage options, which could result in out-of-pocket expenses in the instance of a claim. Verify you comprehend what each policy covers and evaluate whether the affordability justifies any trade-offs in coverage.

Additionally, consider the reputation of the insurance companies you are evaluating. It's not just about the cost; the quality of customer service and claims support can make a large difference when you need help. Find feedback and ratings to find out how well the insurers handle with claims and their level of customer service, ensuring you pick a policy that offers both cost-effectiveness and trustworthiness.

Tips for Lowering Insurance Costs

In order to lower your property owner insurance costs, begin by comparing rates and evaluating quotes from multiple insurers. Each company assesses risk in its own way and offers different discounts. Make use of online comparison tools and think about reaching out straight to insurers to negotiate better rates. Be sure to get thorough quotes that clarify coverage to ensure you’re making valid comparisons.

A different effective way to reduce your premiums is by raising your deductibles. A higher deductible means you'll pay more out-of-pocket in the instance of a claim, but this might reduce your regular premium. Carefully evaluate your financial situation to decide on a deductible that you can comfortably afford in case of an emergency while still taking advantage of lower insurance costs.

Additionally, consider making improvements to your properties that can reduce potential risks. Upgrading tips for getting the cheapest discount landlord insurance quotes as smoke detectors, security systems, and proper wiring can lead to discounts from insurers. A few companies even offer rewards for landlords who regularly maintain their properties, so keep records to show your commitment to property upkeep and safety.